How are Equity Investments in Property Projects now on the Increase?

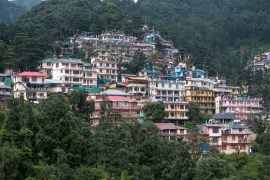

Look back as little as ten years and you’d find a very different Indian Property Market from the one we know today: Central Government Policy on Property, indeed the very question of whether the Government even had a Property Policy worthy of the name, was a vexatious and thinly understood issue. In particular, the Indian Government had markedly failed to come to terms with radical problems caused by a surge in unplanned urbanisation, unleashed by the rapid strengthening of the underlying economy; in addition to which income disparity and sector specific unemployment across the subcontinent had also contributed to a national housing shortage which was running at 51 million units by 2011.

But that’s all changed now.

Equity Investments in Property Projects are now on the increase. According to this month’s JLL India Report, out of a total of $5.2 Billion worth of private equity investments over the last two years, no less than 43% were effected in Property Projects using equity structures (that is, investment in the corporate vehicle carrying out the development rather than the resulting bricks and mortar put on sale to the public); and in the year to date, more than $2.8 Billion worth of these platforms have been created and are focused on producing affordable and middle-income housing.

All that may sound like dry statistics, but don’t be fooled. It points to a deeper fact of potentially profound importance to the future of the property sector on the subcontinent.

Investors will usually only make an equity investment of that kind if they are confident the project will actually be seen through to completion at a profit. Ask anyone involved in project finance and they will tell you that despite all the millions invested and no matter how good it looks, a power station is only worth having if it’s finished and has started generating power. Nobody wants a half built Facility just as nobody wants a half-built block of flats, and a half-built block of flats will do nothing to address an urban housing shortage. It will do nothing, in short, to deal with that 51 million shortfalls from 2011.

All of which brings us back to the role of Central Government in India because it has finally woken up to the need to step in and help chart for investors a clear course through a development’s life; giving in the process the sort of assurances on effective completion that equity investors have traditionally been lacking.

Its key instrument of policy has been the Real Estate (Property and Development) Act 2016 (“REDA”).

All commercial and residential real estate projects of 500 square meters and more (that’s all the projects that matter) must now be registered under the terms of REDA with the Real Estate Regulatory Authority (“RERA”), and RERA then acts as an agent to provide greater transparency on what the project in question involves and on when it is likely to be completed. Cast your mind back to the power station analogy; RERA gives the transparency an investor needs to understand enough about the project to make it worth investing in. It’s not a shot in the dark on whether it will be completed at all.

So it should be no surprise to hear on the back of REDA coming into force this year that the level of equity investment in property projects has increased so radically. The legislation is an astute and well directed effort by the Indian Government to respond proactively to an investment need; and the results are striking if we look at the JLL statistics.

They could even be about to get more striking still because the Government of Prime Minister Modi has now released a set of Executory Rules designed to give the legislation more teeth at State level; and all States save Karnataka had implemented those Rules by the beginning of November.

As for future prospects, this month’s JLL India Report wasn’t mincing its words either:

“From the Investor’s point of view there couldn’t be a better time. Earlier, lack of uniformity and transparency were the key challenges the real estate sector was plagued with and this had kept equity investment at bay…..Today, however, the change towards better corporate governance and higher transparency is being seen across all industries, but especially real estate”.

We’ve come a long way in the last ten years.

Red Ribbon CEO, Suchit Punnose said:

It is true that the sheer scale of investment into Infrastructure right across India is simply staggering at the moment. But that is a necessary price to pay if economic growth across the subcontinent is to be maintained at anything like its recent historic rates. Moving goods around the country, moving people around and securing effective transit of raw materials: these are all essential for a modern, global economy. And I am heartened to seeing them being addressed as a priority because they are a priority.

I am looking forward to seeing just how and at what level the Government proposes next to secure a fully effective “joining up” of the infrastructure as it becomes available.

Leave a Reply