Saving for the Future: India’s Dynamic Asymmetry

Saving for the Future: India’s Dynamic Asymmetry

India: in the space of a single generation the subcontinent has increased its savings to GDP ratio from 13.9% to a simply astonishing 30%

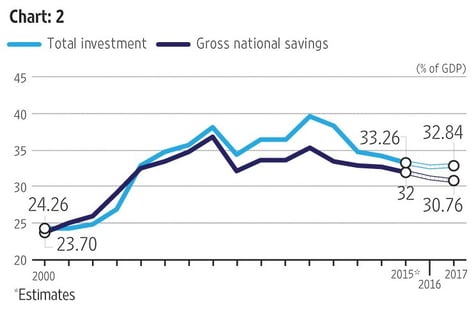

The domestic savings account played a key part in Japan’s economic miracle: with an increasingly wealthy and traditionally conservative population storing up personal wealth at unprecedented levels, the country achieved one of the highest savings to GDP ratios anywhere in the world by the mid 1980s and Japanese business wasn’t slow to draw on it to fuel its increasingly ambitious investment programmes. The rest, of course, was history. And Japan still has one of the highest Savings to GDP ratios in the world at 24.4%, but it’s no longer the highest ratio. That prize now goes to India: in the space of a single generation the subcontinent has increased its savings to GDP ratio from 13.9% to a simply astonishing 30%. Compare that to the United States, which is languishing at 16.9% and the United Kingdom at 14.8% (less than half of India’s current figure).

India Savings-GDP ratio - Red Ribbon Asset Management

India Savings-GDP ratio - Red Ribbon Asset Management

And as we know from Japan’s savings fuelled economic miracle of the 1980’s, these things really do matter: in a resurgent economy such as India, companies simply cannot do without a resilient and liquid stock of capital to fuel forward investment, and history has taught us time and time again (most recently, again, in Japan) that the best source of liquid capital is the liquid cash, in a form capable of being made available commercially through public equity and capital markets. Conversely, history has certainly taught is that a wholly credit fuelled investment surge is not to be trusted, even in the medium (which is no doubt why the United States and the UK are running at such historically low savings to GDP ratios at the moment).

Now that India has taken the lead in this crucial metric, it is interesting to note too the gradual process of increased capitalisation which is inexorably turning its huge pool of cash into investment capital for future growth. For example, there are at the moment more than 7,800 separate stocks listed on India’s exchanges, but less than 3,000 of these are actively traded; and by parity of reasoning, bond trading (a key indicator of the vibrancy of any capital market) accounts at the moment for less than 75% of overall market activity in India. This all points to an obvious and marked under participation by the subcontinent’s population of over a billion (and rising), with only 18 million of these actively investing in equities and ten of the major urban conurbations by themselves accounting for more than 80% of trading volumes. Economists would call this a dynamic asymmetry: an unstable basis for positive future growth.

Because current levels of participation are not a problem for India but rather, a mark of just how much can still be achieved in a non-saturated market, with a huge supply of liquid capital and a Government committed to driving forward investment programmes on a scale which would have been beyond our wildest dreams even twenty years ago. In a saturated market with little or no short-term liquidity it would be a very different matter, but that’s a problem more likely to be found these days in uptown Manhattan than downtown Mumbai.

Which is why domestic saving volumes are likely to play a key part in India’s explosive growth over the coming years, underpinning the key strengths of Red Ribbon’s Private Equity Fund which aims to achieve both dividend yield and capital growth by investing in Indian Businesses which benefit from improved capital liquidity trends in this, the fastest growing Growth Market in the world.

[nectar_btn size="large" open_new_tab="true" button_style="regular" button_color_2="Accent-Color" color_override="#7b1627" icon_family="none" url="https://bp276-023e50.pages.infusionsoft.net/" text="Private Equity Fund" css_animation="none" margin_top="10" margin_right="20" margin_bottom="10" margin_left="20"][social_buttons full_width_icons="true" facebook="true" twitter="true" google_plus="true" linkedin="true" pinterest="true"]

Leave a Reply