Joining the Dots for the Future…A walk around Indian Real Estate Markets

History doesn’t move in straight lines, we’re much too unpredictable for that: so nobody should be surprised that in the same month as a group of glum beancounters at the Office for National Statistics reported a 20.4% slump in GDP for the UK (the worst ever), their happier colleagues at the Land Registry were trumpeting a 2.6%, year on year increase in UK property prices. There isn’t a straight line between the two: the underlying decisionmaking is just too unpredictable to allow for anything more than a childish squiggle. It’s what practitioners of the dark arts of econometrics call “a random walk”, like a drunk stumbling home from the pub: we know where he started out from and where he ended up, but it’s the bit in the middle that’s a mystery. Why did the catastrophic oil crisis of 1973 barely make a dent on US property prices, having sent the rest of the economy into free fall? Why did an otherwise localised slump in US property prices cause economies across the world to crash in 2008? These are random walks between two points (or pints in the case of our drinker) … the trick is to join the points up.

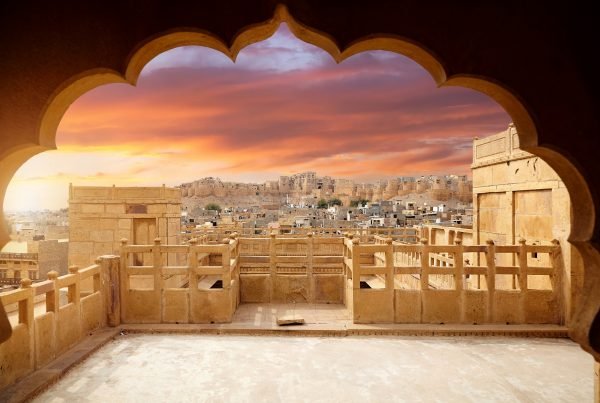

Which means searching for medium and long term trends, key drivers that act as a platform for what the future might look like: and there’s no better example right now than India’s Real Estate Markets.

According to an influential IBEF forecast, Indian Real Estate will be worth $1 Trillion within the next ten years (from a base of $120 Billion in 2017), and by 2025 (just five years away in case we forget), the sector as a whole will make up 13% of the subcontinent’s GDP. That’s worth reflecting on: despite the near term, COVID driven shocks, not to mention the pandemic’s catastrophic impact on overall levels of social cohesion, there is no straight line in sight: the subcontinent’s residential and commercial property markets are showing persistent and robust signs of long term growth, and this particular honey pot is proving as attractive as it was when, in 2019, overseas and mostly private equity investors staked no less than $14 Billion in the sector.

Blackstone alone has invested more than $12 Billion in Indian real estate since 2018: including the first of the subcontinent’s newly established REIT’s, which raised $670 Million in 2019 in collaboration with Embassy Group.

In response to (and partly in anticipation of) that inexorable trend, the Indian Government launched a series of property-related initiatives, including the Smart City Mission: delivering more than a hundred better-connected infrastructure and technology centres across the country and offering a prime opportunity for investors. Add to that the recent launch of the Alternative Investment Fund (AIF), which green-lighted investment across 1,600, previously stalled urban housing projects in major conurbations from Mumbai to Chennai and, of course, the continued resurgence of the Affordable Housing Fund. Prime Minister Modi’s Government has also approved the creation of 417 new Special Economic Zones, of which 238 are now live. Impactful as it might be at the moment, COVID 19 has neither the persistence nor potential to stand in the way.

As Blackstone themselves could no doubt testify, Foreign Direct Investment is a key part of this mix: increasingly responding positively to enhanced levels of market transparency on the subcontinent, a transparency that has acted as a powerful nudge to create a more investment-friendly environment increasingly aligned to western markets (and due diligence requirements in particular).

So there’s no straight line to follow in these turbulent (short term) times, only an increasingly less random walk firmly rooted by a long-term compass. And, to repeat the point, there’s no better example of that at the moment than Indian Real Estate Markets.

Modulex is setting up the world’s largest steel modular buildings factory based in India. It was established by Red Ribbon to harness the full potential of fast-evolving technologies and deliver at pace to meet the evolving needs of the community.

Executive Overview

Every so often we have to raise our eyes from the papers on the table, and goodness knows we’ve had enough to distract our attention from the bigger picture over recent months: that’s why, as we gradually emerge from global lockdowns, I’m confident longer term trends will be much more important than any of our day to day fixations.

I’m confident, in short, that the future can’t and won’t be navigated by straight lines…

Leave a Reply